Investing in Success: Uncovering Opportunities with Forex Companies for Sale

The world of finance is constantly evolving, and with the rise of digital currency and online trading platforms, the Forex market has emerged as a prime investment arena. For individuals and businesses looking to enter this lucrative field, the option to consider a Forex company for sale presents a unique opportunity. In this comprehensive guide, we will delve into what makes a Forex company a valuable investment, how to navigate the buying process, and factors to consider for a prosperous future in trading.

Understanding the Forex Market

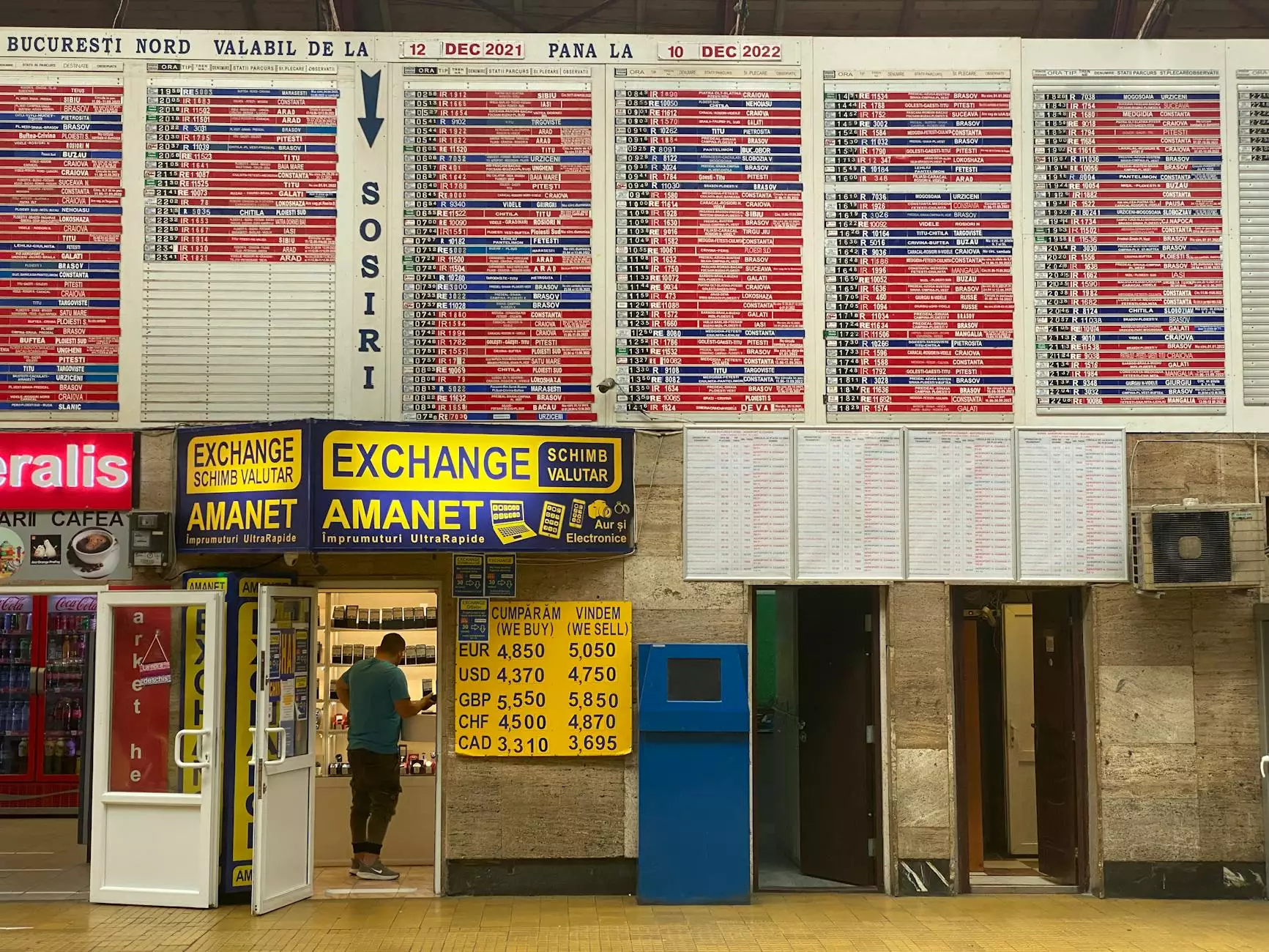

Forex, or foreign exchange, is the largest financial market in the world. With a daily trading volume exceeding $6 trillion, it offers unparalleled liquidity. This market allows individuals, corporations, and institutions to trade currencies, hedge against risks, and invest for profit. Here are some essential aspects to understand:

- Market Dynamics: The Forex market operates 24 hours a day, five days a week, allowing traders to capitalize on currency fluctuations at any time.

- Leverage Opportunities: Forex trading typically involves high leverage, enabling traders to control larger positions with smaller amounts of capital.

- Accessibility: The entry barriers in terms of capital are relatively lower than in other markets, making Forex trading accessible to retail traders.

Why Invest in a Forex Company?

Investing in a Forex company is an appealing option for several reasons:

- Established Client Base: Many Forex companies already have a loyal client base, which can translate into immediate revenue streams.

- Brand Recognition: Buying an established Forex firm can save time and resources associated with brand building.

- Diverse Revenue Streams: Forex companies often have multiple streams of income, including trading commissions, spreads, and additional services.

Key Considerations When Buying a Forex Company

Before proceeding with the purchase of a Forex company for sale, there are numerous considerations to bear in mind:

1. Regulatory Compliance

Ensuring that the company operates under the right licenses and complies with regulatory requirements is crucial. This guarantees the legitimacy of the business and protects you from potential legal issues.

2. Financial Audit

A thorough financial audit should be conducted to evaluate the company’s profitability, losses, outstanding debts, and assets. Understanding the financial health of the company will inform your decision-making process.

3. Customer Satisfaction

Review customer feedback and ratings. A company with a strong reputation for quality service can provide a solid foundation for future growth.

4. Technology and Infrastructure

The trading platforms and technology utilized by the Forex company should be assessed. Look for platforms that are user-friendly, reliable, and equipped with advanced trading features.

5. Marketing and Branding

Evaluate the existing marketing strategies and branding of the Forex business. A a solid marketing plan can greatly enhance your ability to attract new clients.

Steps to Purchase a Forex Company

Once you’ve analyzed the crucial factors, the following steps can guide you through the purchasing process:

1. Research Available Listings

Start by browsing listings specifically for Forex companies for sale. Websites, brokerages, and financial marketplaces dedicated to business sales will often have a wealth of options.

2. Engage a Business Broker

Consider hiring a business broker who specializes in Forex companies. They can help navigate the complexities of the sale and ensure you find a company that aligns with your goals.

3. Negotiate Terms

Once you identify a potential company, negotiations are key. Determine fair pricing considering financial assessments and offer terms that benefit both parties.

4. Legal Compliance

Engage with a legal professional to draft and review contracts. Legalities in Forex companies can be complex, so it’s crucial to have expert guidance.

5. Transition Planning

Ensure a solid plan for transition. Integrating your strategies with the existing operations will be necessary to maintain and grow the customer base.

Potential Challenges and How to Overcome Them

Like any business acquisition, there are challenges that might arise:

- Market Volatility: Forex markets can be unpredictable. Staying informed and applying solid risk management is essential.

- Integration Issues: Aligning your business practices with the existing company can pose challenges. Clear communication and training are key to overcoming this hurdle.

- Technological Adaptation: Upgrading or modifying existing technology might be necessary. Training staff on new systems is crucial for success.

The Future of Forex Businesses

As cryptocurrency gains traction and technology continues to advance, the Forex market is likely to undergo significant changes. Staying ahead of industry trends and adapting accordingly will be vital for success. Here are some future trends to watch for:

- Increased Regulation: Governments worldwide are tightening regulations. Companies that adapt to these changes will have a competitive advantage.

- Technological Advancements: AI and machine learning are set to revolutionize trading strategies, providing sophisticated analytical tools for traders.

- Rise of Social Trading: Platforms that facilitate social trading are likely to grow, allowing traders to follow and mimic the strategies of successful investors.

Conclusion: Seizing the Opportunity

Investing in a Forex company for sale represents an opportunity to tap into a dynamic and profitable market. By understanding the intricacies of the Forex landscape and conducting thorough due diligence, you can pave the way for a successful investment. With the right strategies, resources, and foresight, entering this market can lead to substantial returns. Always remember, while the Forex market is full of potential, it also requires diligent observation and strategic management for long-term success.

For those interested in exploring current opportunities in the Forex market, visit eli-deal.com to find comprehensive listings and expert insights on Forex companies available for sale—your gateway to future financial success!